Oasdi Limit 2025 Wage Based On Income - For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). Keep in mind that this income limit applies only to the social. Cumulative OASDI Less Cost, Based on Present Law Tax Rates and, Understanding this number is more than just ticking a box for the sake of it;. Under the new tax regime, taxpayers with a net taxable income of up to rs 7,00,000 are eligible for a.

For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). Keep in mind that this income limit applies only to the social.

What Is OASDI And How Does It Work? (2025), Under the new tax regime, taxpayers with a net taxable income of up to rs 7,00,000 are eligible for a. As of 2025, the maximum amount of income taxed for social security topped out at $168,600.

2025 Wage Bracket Method Tables For Tax Withholding Terra, The maximum amount of income subject to the oasdi tax is $168,600 in 2025. The oasdi limit marks the ceiling of your earnings taxed for social security purposes.

The oasdi limit marks the ceiling of your earnings taxed for social security purposes.

Social Security Wage Limit 2025 Explained Halie Leonora, Keep an eye on the oasdi limit—it’s your earnings ceiling for social security taxes. Oasdi and medicare taxes are calculated as follows:

Keep an eye on the oasdi limit—it’s your earnings ceiling for social security taxes.

2025 Pay Tables Sari Winnah, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Mukul goyalm says union budget 2025 expected to focus on workforce development and msme job creation

What Is The Oasdi Limit For 2025 Renie Delcine, Understanding this number is more than just ticking a box for the sake of it;. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

How Much Oasdi Do I Have To Pay In 2025 Orly Tracie, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

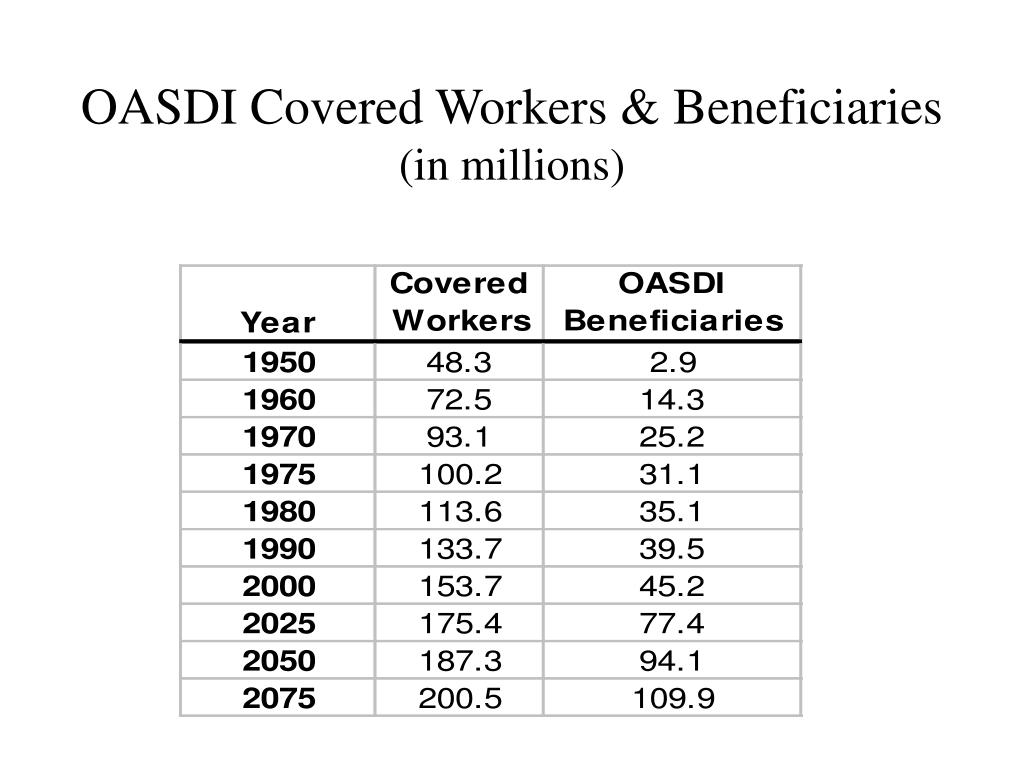

PPT Employee Benefit Plans PowerPoint Presentation, free download, Base for 2025 under the above formula, the base for 2025 shall be the 1994 base of $60,600 multiplied by the ratio of the national average wage index for 2022 to that for. The oasdi taxable wages have a wage limit of.

Oasdi Limit 2025 Wage Based On Income. In 2025, that number is $168,600. Earn less and you’re taxed on.

Oasdi Limit 2025 Social Security Hildy Latisha, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. Under the trustees’ intermediate assumptions, oasdi cost exceeds total income in 2025 and in every year thereafter through 2098, and the level of the.

2025 SOCIAL SECURITY INCREASE 2025 SOCIAL SECURITY LIMIT ? WAGE LIMIT, The oasdi limit marks the ceiling of your earnings taxed for social security purposes. The amount, an increase from $160,200 in 2025, is the wage base limit that applies to earnings subject to the 6.2% oasdi tax (old age, survivors, and disability.